Marketing Representative Bundles :: 10 CPE Points Per Course

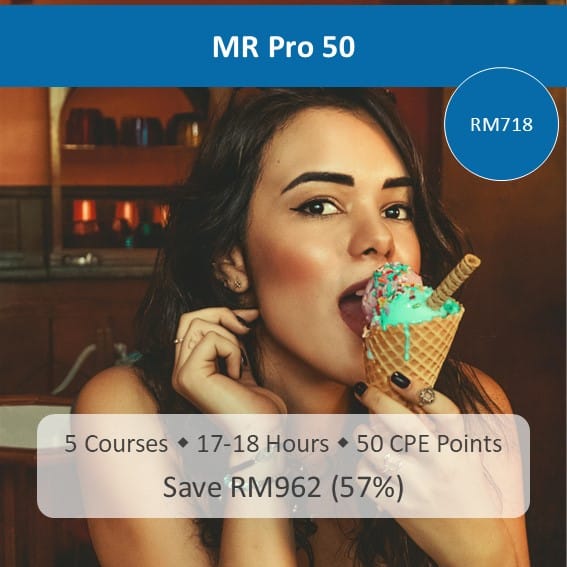

MR Pro 50 | 5 Courses x 10 CPE Points

SIDC-Approved: 50 CPE Points

Learn more or watch preview

MR Pro 40 | 4 Courses x 10 CPE Points

SIDC-Approved: 40 CPE Points

Learn more or watch preview

MR Pro 30 | 3 Courses x 10 CPE Points

SIDC-Approved: 30 CPE Points

Learn more or watch preview

MR Pro 20A | 2 Courses x 10 CPE Points

SIDC-Approved: 20 CPE Points

Learn more or watch preview

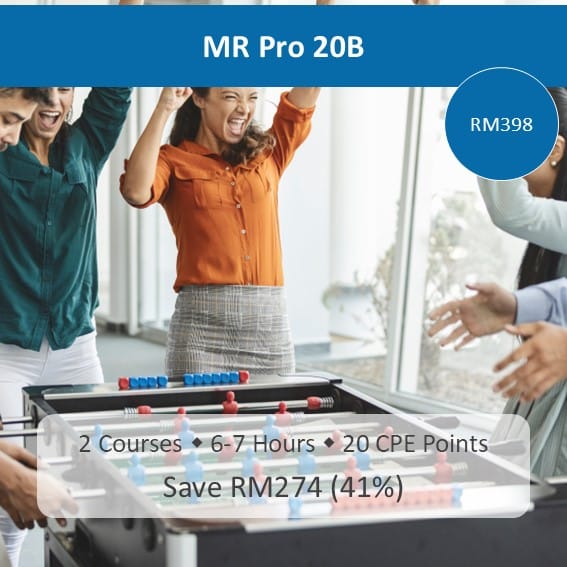

MR Pro 20B | 2 Courses x 10 CPE Points

SIDC-Approved: 20 CPE Points

Learn more or watch preview

4 Course Bundle :: 20 CPE Points in 5-6 Hours

Complete Starter Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Marketing Representative Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Islamic Finance Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Project Finance Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Special Treasury Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Financial Modelling Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Capital Markets Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Project Investment Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Financial Planner Package

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Custom 4 course bundle.

Think you can do better than us? Try it out yourself.

3 Course Bundle :: 15 CPE Points in 3-4 Hours

Marketing Representative Triplex

SIDC-Approved: 15 CPE Points

Learn more or watch preview

Capital Markets Triplex

SIDC-Approved: 15 CPE Points

Learn more or watch preview

Risk Management Triplex

SIDC-Approved: 15 CPE Points

Learn more or watch preview

Financial Markets Triplex

SIDC-Approved: 15 CPE Points

Learn more or watch preview

Custom 3 course bundle.

Not what you want? Configure your own set.

2 Course Bundle :: 10 CPE Points in 2-3 Hours

Perfect-10: Project Finance & Monetary Economics

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Islamic Economics & Shariah Documentation

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Valuation Fundamentals & Sukuk Valuation

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Anti-Money Laundering

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Shariah Fundamentals & Risk Management

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Islamic Economics & Islamic Swaps

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Project Finance

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Valuation Part I

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Perfect-10: Financial Modelling & Term Sheets

SIDC-Approved: 10 CPE Points

Learn more or watch preview

Custom 2 course bundle.

Do you have something else in mind? Let’s see what you got.

Intensive Financial Modelling :: 20 CPE Points in 7-8 Hours

Intensive Financial Modelling

Bundle: 2 courses x 10 CPE points

NVFM211 Financial Modelling for Project Finance using Microsoft Excel

Trainer: Helmi (click for profile)