OUR LATEST COURSES

Choose your augmentation from project finance, financial modelling and anti-money laundering.

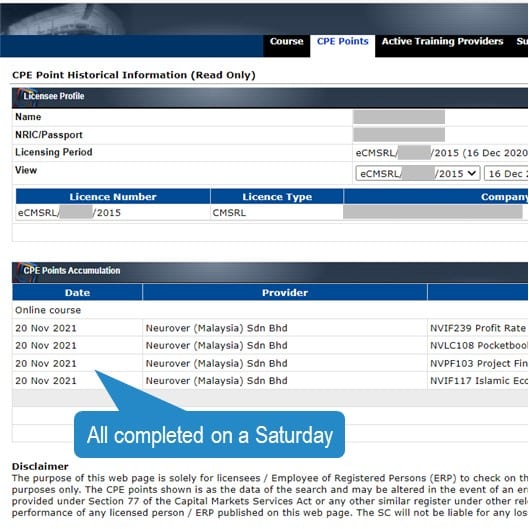

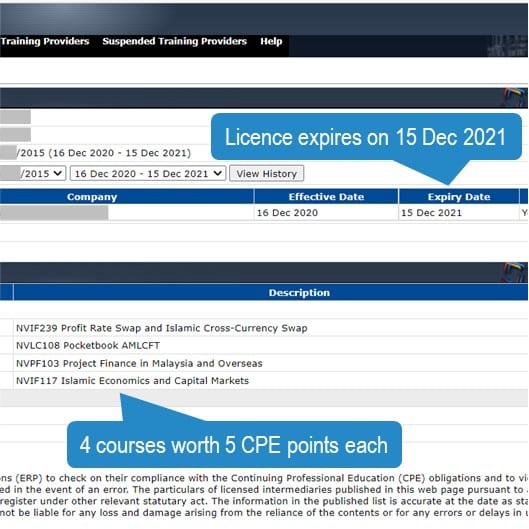

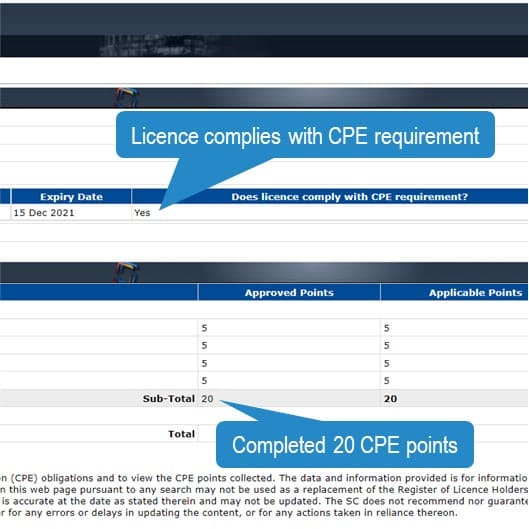

Save Time

3 hours to get 10 CPE points and 6 hours for 20 CPE points

Any Device

Designed for busy professionals who are always on-the-go

Industry-Relevant

Critical cutting-edge mastery for a powerful career boost

Secure

Highest standard encrypted payment and delivery system

30 Day Access

Longer access period means easier to plan your schedule

Bulk Discount

Up to 60% discount when you purchase together with friends

Money Back Guarantee

We will return your payment if you are not satisfied*

Capital Markets

Islamic Finance

Project Finance

Valuations

Anti-Money Laundering & Risk Management

Financial Modelling

Do you need time to go through our catalogue?

Our brochure has details on our courses and our special packages. Please make sure to come back here for the updated version because we add a new course to our catalogue every two months. Also, we have new special packages announced often.

And if you feel like talking to someone, you can reach out to us at +60193539093 or email us at mail@neurover.com. We will be happy to answer your questions.

When you have decided on the course, you can come back here to register online or you can fill up the registration form on the last pages of the brochure and email to us.

Our international technology partners you can trust

* Terms and conditions apply.