Marketing Representative (MR) Bundles

Kami membantu ramai pelanggan kami mengambil kursus sebagai syarat untuk memperbaharui lesen Wakil Pemasaran (MR) dengan pantas melalui peranti mudahalih supaya mereka boleh terus bergiat di dalam bidang pilihan.

We have helped many of our customers in completing their courses as a pre-requisitie towards renewing their Marketing Representative (MR) licences quickly using mobile devices so that they can continue working in their chosen fields.

MR Pro 50 | 5 Courses x 10 CPE Points

Course 1 :: NVCM273 Comparison Method of Valuation

Duration 3 1/4 hours SIDC Approved 10 CPE Points

Preview Click here for preview

Summary This is the third instalment of the valuation series following NVCM163 Fundamentals of Valuation and NVCM263 Cost Method of Valuation. The comparison method of valuation is one of the most common approaches used in the capital markets because of its flexibility. This course looks at common applications of the comparison method, exposes the psychology behind the approaches, investigates their shortcomings, and proposes a spectacular transformation in visualising the capital markets.

Course Outline 1.1 Recap of the cost method of valuation and example of the market gone wrong 1.2 Rationale for the comparison, cost and income methods, and application of each valuation method in the capital markets 2.1 Relationship between comparison method, fundamental analysis and technical analysis 2.2 Financial metrics and ratios as key drivers of value 2.3 Comparing financial results 2.4 Business metrics and ratios 2.5 Balanced scorecard 2.6 Key drivers of selected industries and the economy 2.7 Drawbacks of the comparison method of valuation

Course 2 :: NVCM283 Income Method of Valuation (Part 1)

Duration 3 1/4 hours SIDC Approved 10 CPE Points

Preview Click here for preview

Summary This is the fourth instalment of the valuation series following NVCM163 Fundamentals of Valuation, NVCM263 Cost Method of Valuation and NVCM263 Cost Method of Valuation. The income method of valuation is known as the most in-depth and complex of all the methods. We have broken up the income method of valuation into two parts. In this course, we explore the multiple facets of the discount rate. Participants will come to realise that deciding on the rate to apply in their valuation process requires a more holistic understanding of benchmark yields, corporate issuances, pricing models, monetary policy, and supply and demand dynamics in the capital markets. The upcoming NVCM293 Income Method of Valuation (Part 2) will look into applying the discount rate to the cash flows to complete the valuation computation, and cap off the series.

Course Outline 1.1 Recap of the cost and comparison methods of valuation 1.2 Role of psychology on the markets and valuation 1.3 Rationale and application of the income method in the capital markets 2.1 Underlying principles of valuation and 5Cs of credit 2.2 Opportunity cost and time value of money 2.3 Present value, future value and financial mathematics 2.4 Risk 2.5 Discount rate and risk-free rate 2.6 Weighted average cost of capital (WACC), cost of equity and capital asset pricing model (CAPM) 2.7 Nominal rate and effective rate 2.8 Floating rate 2.9 Overnight policy rate, open market operations and fixed rate 2.10 Manipulation of market data 2.11 Spot rates, forward rates, and relationship between short-term and long-term rates 2.12 Role of arbitrage 2.13 Benchmark yield curves 2.14 Corporate yield curves 2.15 Shapes of the yield curve 2.16 Yield pick-up 2.17 Market practice for discount rates 2.18 Discount factor

Course 3 :: NVCM293 Income Method of Valuation (Part 2)

Duration 3 1/4 hours SIDC Approved 10 CPE Points

Preview Click here for preview

Summary This is the fifth instalment of the valuation series and Part 2 of the income method of valuation. The income method of valuation is the go-to approach used in the capital markets where accuracy is the primary driving force. In this course, we apply the concepts of time value of money, discount rate and cashflows that we learnt in Part 1 on various kinds of capital market products. We look at the differences between the products and uncover the reasons for variations in the resulting valuations. You will be equipped with a comprehensive appreciation of the income method of valuation by exploring its strengths and weaknesses, and by gaining an astute understanding of theory vs real world.

Course Outline 1.1 Recap of opportunity cost, time value of money and discount rate 1.2 Discounted cash flows (DCF) 1.3 Cash flow projections 1.4 Fixed cash flows – fixed income securities, projects and dividend-paying stocks 1.5 Volatile cash flows – companies with unpredictable dividends, options, and convertible sukuk and bonds 1.6 Concept of capitalisation 1.7 Net operating income (NOI) 1.8 Capitalisation rate 1.9 Comparison between capitalisation and discounted cash flows (DCF) 2.1 Drawbacks of the income method of valuation 2.2 Compare and contrast the income, cost and comparison methods

Course 4 :: NVFM211 Financial Modelling for Project Finance using Microsoft Excel

Duration 3 1/2 hours SIDC Approved 10 CPE Points

Preview Click here for preview

Summary This is part one of the hands-on tutorial on financial modelling for project finance using Microsoft Excel. We build the cashflows statement starting from the assumptions page followed by the computations for revenues, capital expenditure, operating expenses, income tax and financing. The focus point of this course is the automated financing repayment schedule using Microsoft Visual Basic for Applications (VBA).

Course Outline 1.1 Layout of the assumptions and cashflow pages 1.2 Construction and operating flags 2.1-2.5 Compute revenues, capital expenditure, operating expense and income tax 2.6 Compute the size of sukuk (bonds) and equity 2.7 Compute the finance service reserve account and maintenance reserve account 3.1 Overview of finance service coverage ratio 3.2 Compute the finance service coverage ratios 4.1 Sukuk (bonds) pricing 4.2 Principal repayment for term facility and sukuk (bonds) 4.3-4.4 Sukuk (bonds) principal and profit payments 4.5 Circular reference 4.6 Dividends 4.7-4.8 Visual Basic for Applications (VBA) 5.1 Base case and stress case

Course 5 :: NVFM223 Complete Project Finance Modelling using Microsoft Excel

Duration 4 hours SIDC Approved 10 CPE Points

Preview Click here for preview

Summary This is part two of the hands-on tutorial on financial modelling for project finance using Microsoft Excel. We continue with the profit and loss statement and balance sheet and expand on the sukuk (bonds) tranching concept. The climax of this course is the automated sukuk (bonds) tranching computation – the first in the world!

Course Outline 1.1 Sections in the Assumptions page 1.2 Flags and other sections in the Cashflows page 2.1 Construction, revenue, expense and financing assumptions 2.2 Sources of information and reasonableness of the assumptions 3.1 Computations for cash inflows and cash outflows, debt and equity, and finance service reserve account 4.1 Significance of the profit and loss statement and balance sheet, and computation of retained profits 4.2 Depreciation, cash, borrowings and shareholders’ funds 4.3 Finance service coverage ratio and finance-to-equity ratio 5.1 Computation of dividends and shareholders’ cashflows 5.2 Discount rate, internal rate of return and net present value 6.1 Yield-to-maturity and price, spot and forward issuances, target investors, and term facility vs sukuk 6.2 Circular reference and automating the principal payment computation 6.3 Principal payment computation using Visual Basic for Applications (VBA) 7.1 Manual sukuk (bonds) tranching computation 7.2 Process of automating the tranching computation, sukuk trading lots, and discrete and continuous variables 7.3 Automated sukuk (bonds) tranching formulas

Total 5 courses for 50 CPE points

Normal price RM1,680

Save RM962 (Discount 57%)

Other Marketing Representative Bundles

MR Pro 40 | 4 Courses x 10 CPE Points

SIDC-Approved: 40 CPE Points

Learn more or watch preview

MR Pro 30 | 3 Courses x 10 CPE Points

SIDC-Approved: 30 CPE Points

Learn more or watch preview

MR Pro 20A | 2 Courses x 10 CPE Points

SIDC-Approved: 20 CPE Points

Learn more or watch preview

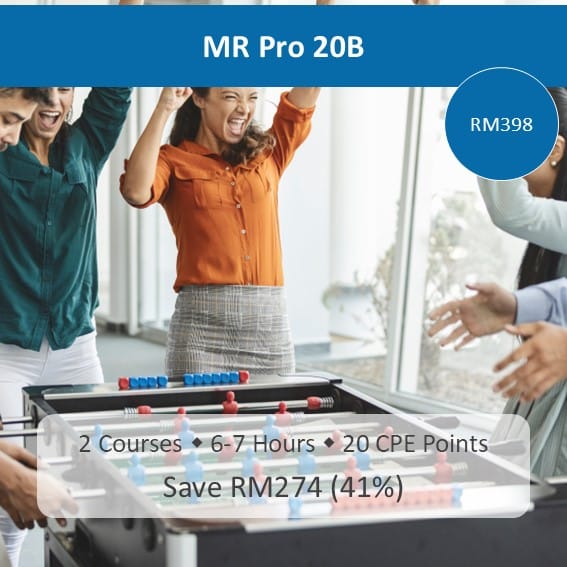

MR Pro 20B | 2 Courses x 10 CPE Points

SIDC-Approved: 20 CPE Points

Learn more or watch preview

Group Registration

Additional discounts if you register in a group of 2 or more persons

Contact us at [email protected] or +60193539093 for more details